South Africa is in a technical recession – what now? Two economists from the North-West University (NWU) discuss the implications of this for the economy.

They say urgent structural change and clear economic policy are now of the utmost importance.

Prof Danie Meyer and Roan Neethling, a doctoral student, say the country has been caught up in a low-growth trap since 2009, and 2019 has been no exception, with an overall growth of only 0,2%.

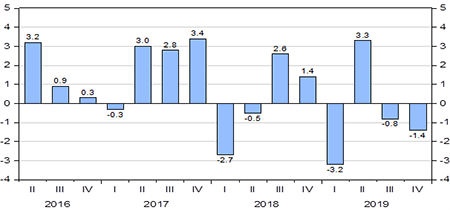

“Figure 1 below indicates the poor growth performance from 2016 to 2019. Following an economic slowdown in the third quarter of 2019 when growth declined by -0,8%, the fourth quarter of 2019 had an even worse performance when the growth declined by -1,4%,” says Prof Meyer.

According to Prof Meyer and Roan, the sectors that contributed the most towards the negative growth were the agricultural sector, transport and trade.

“Predictions for economic growth in 2020 are still very low at between 0,3 and 0,6% due to lack of a stable power supply, policy uncertainty regarding all the economic sectors, a government that lacks implementation capabilities, rapidly rising government debt, and possible global economic slowdown due to the coronavirus.”

Prof Meyer says it is expected that growth in the first quarter of 2020 (January to March) will also be negative.

Figure 1: % GDP change quarter-on-quarter

Prof Meyer and Roan say the implications of the results of the economic output data for the economy are:

- The low and even negative economic growth environment will continue well into 2021, with the main limiting factor being the unstable electricity supply by Eskom.

- Capital investment in the local economy is still declining (10% in the last quarter) due to lack of business confidence. Business confidence is at its lowest level since 2009. This means that local industries are not planning any expansion during 2020, leading to no new jobs in the short term, but rather to job losses in a very restrictive labour environment.

- Consumers will be under even more pressure due to slow growth in job opportunities and income. Consumer spending contributes approximately 60% to aggregate expenditure in the economy, and a slowdown in this expenditure will have a further negative impact on growth outlooks.

- Inflation (CPI) is currently on an upward trend and cost of production (PPI) is also increasing in a low-growth environment. This means that prices will continue to rise, resulting in stagflation.

- All the main economic base sectors such as agriculture, mining, manufacturing and construction that are the drivers of the economy are on a declining trend and need to be more competitive on a global scale.

- Lastly, urgent structural change with clear economic policy is now required in an unstable global environment. The level of panic is reflected by the 0,5% interest rate reduction by the US FED on 3 March. We need urgent action to boost the South African economy.

For more information, contact Prof Danie Meyer at 018 285 2656 or danie.meyer@nwu.ac.za.