Most of the assessed group of metropolitan municipalities in South Africa are not financially healthy, with only three of eight of these metros being profitable, even though there has been a general improvement in their revenue and expenditure ratios.

This is the conclusion of Prof Danie Meyer, a development economist and director of the TRADE research focus area at the North-West University, and Roan Neethling, a PhD student in Economics.

“Local government is seen as the sphere of government closest to the people and responsible for the implementation of projects and service delivery. Over the past decade or so the local government sphere of government has been increasingly under pressure due to financial non-sustainability and poor service delivery,” says Prof Meyer and Neethling.

They say that, according to the Citizen Satisfaction Index as compiled by Consulta, service delivery has declined drastically at all eight the metropolitan municipalities over the past five years. In an analysis of the 2019 municipal report by the auditor-general, Ratings Africa stated that only 8% of all the municipalities received clean audit reports, and irregular spending totalled R32 billion, pinpointing deteriorating conditions in the local government sphere.

Because of the perceived financial problems at local government level, Meyer and Neethling decided to develop a local-government financial-health measurement index that could assist in the assessment of finances at municipalities.

Subsequently, they completed the index and published a research paper in 2019 titled Formulation and Application of a Local Government Financial Health Index (LGFHI): The Case of the Sedibeng Region. (Administratio Publica, 27(4), 235–255).

The LGFHI quantifies all the elements of financial health and focuses on four sub-elements of municipal health, namely (1) income and expenditure, (2) liquidity ratios, (3) solvency ratios, and (4) profitability ratios.

The ratios in the index were calculated by extracting data from audited financial statements as published by the National Treasury for the 2017/2018 and 2018/2019 financial years.

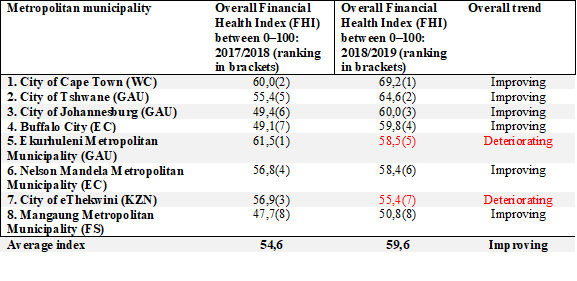

All eight metropolitan municipalities were assessed and the overall results are shown in the table below, where the metros have been ranked from best performing to worst performing in terms of financial health.

“Overall, in terms of the index, the combined index for the metros have improved from 54,6 to 59,6 (index from 0–100), while only two of the eight metros, Ekurhuleni and eThekwini, are presenting deteriorating financial health conditions.”

Prof Meyer and Neethling say the City of Cape Town has the highest ranking with an index of 69,2, followed by City of Tshwane and City of Johannesburg in the 2018/2019 financial year.

“The worst-performing metro in terms of financial health was Mangaung Metro, followed by City of eThekwini. In terms of the sub-elements, City of Tshwane fared the best in terms of revenue and expenditure, while Mangaung Metro was the worst off.”

They say that, in terms of liquidity ratios, the City of Cape Town had the best-performing ratios, while again Mangaung Metro was the worst off. Surprisingly, regarding solvency ratios, which include debt to worth and asset ratios, Buffalo City and Nelson Mandela Bay had the highest index, while City of Tshwane had the lowest index.

“Lastly, in terms of the profitability ratio, City of Cape Town, City of Tshwane and City of Johannesburg had the highest (best) ratios, while all the other metros had extremely poor ratios, indicating evidence of non-profitable or loss-making institutions.”

In the final assessment, the overall index scores are relatively low, with only the top three metros achieving indexes above 60. “Although indexes have improved, most metros are not financially healthy. Only three of the eight metros are profitable, even though the revenue and expenditure ratios have improved for six of the eight metros,” they conclude.

The LGFHI for the eight metropolitan municipalities in South Africa

Source: Own compilation from audited financial statements as published by the National Treasury for the 2018/2019 financial year.

For more information, contact Prof Danie Meyer at 082 850 5656 or daniel.meyer@nwu.ac.za.