Two economists of the North-West University (NWU) say that inflation is expected to continue on an upward trend this month, while the cost of production is also expected to continue to rise as a result of the global uncertainty and supply chain problems.

According to Prof Danie Meyer and Roan Neethling, a doctoral student at the NWU, the Covid-19 virus, together with global uncertainty and electrical supply problems, are creating a “perfect storm” that will have a massive negative impact on economic growth in South Africa, and the recession is definitely expected to continue deep into 2020.

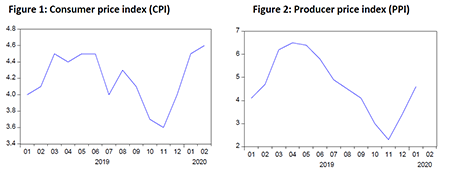

Prof Meyer and Roan explained that StatsSA confirmed on 18 March that consumer price inflation increased from 4,5% in January 2020 to 4,6% in February 2020, while the CPI increased by 1,0% on a month-on-month basis.

“The main contributors to the increase in inflation in February 2020 were food and beverages; household utilities, which include water, electricity and gas; and transportation costs. Stagflation is therefore still evident in the economy, with rising inflation in a contracting economy.”

They say consumers and producers are feeling the effects of rising prices in a low-growth and even contracting economy. The producer price index (PPI), which focuses on the cost of production in the manufacturing sector, increased from 3,4% in December 2019 to 4,6% in January 2020, contributing to an increase of 0,3% month-on-month.

Figure 1 and Figure 2 illustrate the consumer price index (CPI) and producer price index (PPI) for 2019 and the first few months of 2020.

“The trends indicate that both CPI and PPI increased in the later stages of 2019 and the early stages of 2020 despite the recession. The high cost of production is mostly due to the unstable electricity supply, higher labour costs, producer uncertainty, limited international trade, and supply problems due to the Covid-19 virus.”

Prof Meyer and Roan say the spread of the virus will have a huge negative and destructive effect on both global demand and supply due to the fact that production is limited and precautionary steps are taken by governments and producers.

They predict that although the SARB will reduce the repo rate, the impact of this will be limited.

For more information, contact Prof Danie Meyer at 018 285 2656 or danie.meyer@nwu.ac.za.